Informed Sources

Network Rail delay rescues rash franchise bid

It had been common talk around the industry for some months that Virgin Trains East Coast (VTEC) was struggling. And before I go on, remember that while Virgin Trains West Coast (VTWC) is 51% Virgin/49% Stagecoach, East Coast is 90% Stagecoach with a 10% sprinkling of Virgin fairy dust.

I mention this because the glee on social media over what was perceived as Sir Richard Branson’s downfall was unedifying, to put it mildly. Not that Stagecoach founder Sir Brian Souter is any more popular. I find it fascinating how after two decades of privatisation, two now largely peripheral figures can attract such schadenfreude.

Stagecoach’s main man is now Chief Executive Martin Griffiths. Presenting the Group’s preliminary results for the 2016-17 financial year ending 29 April, he revealed that provision had been made for losses of £84.1 million on the Virgin Trains East Coast (VTEC) franchise over the next two years. Revenue growth was proving insufficient to cover the combination of rising premium payments to government and ‘movements in operating costs’.

Stagecoach also recorded a £44.8 million impairment of ‘intangible assets associated with the right to operate the franchise’. This is essentially an acceleration of amortisation and is a non-cash charge.

On top of this, VTEC has also drawn down £57.5 million from the £165 million loan commitment from the two shareholders to fund enhancement in the franchise agreement, such as the £40 million rolling stock fleet upgrade.

STILL PAYING

So far from ‘handing in the keys’, VTEC is still paying the premia in the franchise agreement. According to Martin Griffiths, these payments are 30% more than the average monthly payments by Directly Operated Railways.

But note carefully what else Martin Griffiths said when announcing the losses. ‘We are engaged in discussions with the Department for Transport regarding our respective contractual rights and obligations under the current Virgin Trains East Coast franchise and reflecting the reprioritisation of Network Rail’s infrastructure programme’.

Responding to queries on the announcement, the Department for Transport blustered: ‘We expected franchisees to stand by the contractual obligations’. But those obligations go both ways and it is DfT, as the responsible parent for nationalised Network Rail, that will soon be in default.

VTEC’s winning bid assumed a radical transformation to East Coast services starting with the May 2019 timetable. This would provide more-frequent and faster services operated by the brand new fleet of Hitachi Inter-city Express Programme (IEP) trains.

That will not now happen. The most optimistic start date is now 2021.

WCRM PRECEDENT

So while Stagecoach is prepared to take the losses on the current timetable and maintain the £140 million investment programme, the delay to the service improvements when the premium profile continues to rise year on year would make a continuation of the VTEC franchise on its current terms untenable after May 2019. As Tim Shoveller, Managing Director of the Stagecoach UK Rail Division, told my colleague Tony Miles on 28 June, ‘by definition the (East Coast) bid was based on certainties, and the only thing that’s certain is that the certainties are no longer certain’.

Tim Shoveller sees clear parallels with the West Coast Route Modernisation (WCRM), where Virgin/Stagecoach demonstrated that even though the original 1997 upgrade had ‘fallen apart’ it proved possible to take the principles in the franchise plan and tailor them to what Network Rail eventually delivered. That policy resulted in ‘really significant passenger growth year after year after year and satisfying passengers’ Mr Shoveller adds.

Drawing on this precedent, Mr Shoveller believes that in the current renegotiation of the franchise with DfT, ‘we can take the phoenix from this and there will be a good solution to it – and that will be in the best interests of the taxpayer, the best interests of the customer and the right deal for our shareholders’. But, veteran that he is, Tim Shoveller introduces a note of caution: ‘That’s not where we are today – that’s where we’ve got to get to’.

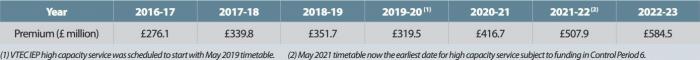

TABLE 1: VIRGIN TRAINS EAST COAST PREMIUM PROFILE

TABLE 2: NETWORK RAIL REPORT FOR ORR

SEPTEMBER 2014

East Coast Connectivity Fund works as proposed for draw-down by the East Coast Programme Board

■ Peterborough station area: 100mph fast line alignment through a new platform 2 face. Increase speed over the Down Slow from 50mph to 100mph (then 75mph over Nene river bridge) between Fletton and Peterborough. Remodel north end of station to improve speeds over Spital ladder.

■ GN/GE Southern Access (Werrington): grade separation, exploring options for flyover or dive under.

■ Doncaster station area: construction of 100m-long bay, bi-directional signalling to the Doncaster East Side (25mph) from Black Carr Junction to Balby bridge, with a new 25mph crossover on the Thorne lines.

■ Shaftholme Junction speed increase: increase turnout speed from 20mph to 40mph and increase the down main linespeed from 100mph to 125mph.

■ York Station North Throat: new line from Platform 11 to the loco line to allow parallel moves into/out of platforms 9/10 and platform 11.

NORTHALLERTON – NEWCASTLE

■ Freight loops at Ferryhill, Ouston–Birtley, Cowton–Eryholme.

NOT IN LIST

■ Woodwalton Junction to Huntingdon: reinstate Up Slow line.

■ Stevenage turnback (new platform).

DELAYED

Network Rail’s business plan for the current Control Period 5 (2014-19) was funded for a range of enhancements supporting the introduction of IEP, such as power supply upgrades and gauging. There was also a ring-fenced East Coast Connectivity Fund worth £240 million. Table 2 shows the proposed enhancements to be covered by the fund.

Together these should have provided the additional capacity allowing the new IEP timetable to be introduced in May 2019. However, projects have slipped and the scope of work progressively cut back. The Hendy Review of 2015 cut East Coast Connectivity fund spending in CP5 to £197.2 million.

As a result, the most optimistic guess for the start of the new timetable is May 2021. But this depends on completion of the original upgrade programme to provide the necessary performance and capacity.

And don’t forget that in addition to VTEC, TransPennine Express will also be introducing more electric trains north of York, not to mention FirstGroup’s open access venture. This will require strengthened power supplies, and while the southern traction Power Supply Upgrade (PSU South) is in place, PSU North is one of Tim Shoveller’s uncertainties. It is even being suggested that until PSU North is ready, VTEC should bin plans to run shortened IC225s on its hourly 4hr London-Edinburgh flyers and life-extend IC125s instead to reduce demand on the power supply.

MESS

All this makes the content of DfT’s High Level Output Specification (HLOS) for CP6 even more critical. This should have been published shortly before this issue appears. It is expected to focus on Operations, Maintenance and Renewals, with enhancements decided as and when funds are available.

Overall, East Coast is probably a sorrier mess than the WCRM (That’s going some! – Ed). As the Iron Duke remarked, ‘the secret of success is consistency to purpose’, a philosophy alien to both Network Rail and its owner DfT. For example, during the East Coast open access wars, DfT threatened to curtail the Connectivity Fund if the Office of Rail and Road (ORR) allocated any of the extra capacity to those nasty open access people. And Network Rail management still seems to see no connection between enhancements to be delivered and train operators’ commitments.

Let’s hope that phoenix wrangler Tim Shoveller can pull something out of the flaming wreck. And a final, merry thought: if VTEC can’t use all those IEPs, we will still keep paying for them under DfT’s 27.5-year train service provision contract.