Roll up the ECML timetable, it will not be wanted in CP6*

Informed Sources

Two uncomfortable truths are emerging from the political storm surrounding the Virgin Trains East Coast (VTEC) financial collapse. The first is that the 2013 Periodic Review (PR13) of Network Rail’s access charges for the current Control Period 5 (2014-19) was an orgy of collusion in delusion by government, the rail regulator and industry. This historic analysis leads into the second truth that current costs are making infrastructure enhancements unaffordable.

Before writing this column, my recollection was that it was the over-reaching ambition of the Government’s High Level Output Specification (HLOS) for CP5, published in 2012, that sowed the seeds for the current situation. In particular, the fact that the upgrades to support the new Inter-city Express Programme (IEP) timetable on the East Coast main line (ECML) will not be ready for May 2020, let alone VTEC’s plans for 2019.

Just to make sure, however, I checked the Initial Industry Business Plan (IIBP) for CP5, produced by Network Rail and the train operators, in conjunction with the supply industry, and published in November 2011. And the aspirations were much the same as those in the HLOS.

In addition to the Great Western and Northern triangle electrification schemes already authorised, the IIBP added the Midland main line electrification (then costed at £216 to £257 million) and Gospel Oak to Barking. It also identified electrification of the North Trans-Pennine route as a ‘strategic investment choice for CP5’, plus electrification of the Cardiff Valleys.

And did ‘Informed Sources’ say ‘steady on, chaps’? Afraid not, so we’re all guilty.

HOT TOPIC

On today’s hot topic, the IIBP said DfT had an aspiration for enhanced long-distance timetables to operate on the East Coast main line ‘commencing in CP5’. It noted that while the proposed train service specification was still under development by DfT, ‘it is anticipated that it will specify additional capacity and better journey times necessitating further investment in network capability during CP5’.

UNPREPARED

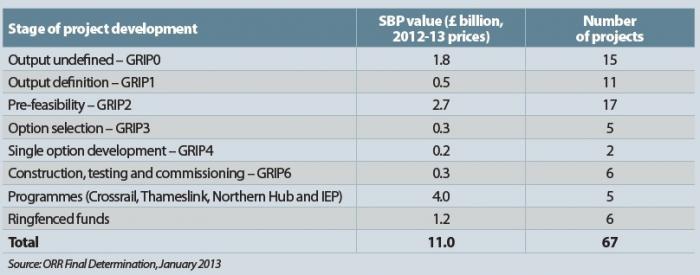

While Network Rail had proposed schemes in the IIBP, as Table 1 shows, development of some two-thirds of the proposed enhancement projects was still between GRIP0 (output undefined) and GRIP2 (pre-feasibility). But, rather like mobilisations in August 1914, PR13 was running to a timetable. Despite the missing costs, the Final Determination for CP5 had to be published on time.

ADJUSTMENT

One list of projects in the Final Determination included 53 major schemes, each with a blank in the costs column, but with a spuriously accurate total of £5.931 billion at the bottom.

EAST COAST CONNECTIVITY

The Secretary of State recognises the importance of the East Coast main line in linking Scotland, the North East, Yorkshire and Eastern England with London. In addition to the schemes already funded, she seeks further improvement in capacity and reduction in journey times and believes there are good business cases for both. The industry should develop plans to deliver works within a maximum CP5 expenditure of £240 million. These plans should include suitable efficient capacity for the crossing flows of passenger and freight traffic at Peterborough. High Level Output Specification for CP5, July 2012

*With acknowledgments to William Pitt the Younger

ALL FOR £247 MILLION

East Coast Connectivity Fund works as proposed for draw down by the East Coast Programme Board, as follows:

■ Peterborough Station Area: 100mph fast line alignment through a new platform 2 face. Increase speed over the Down Slow from 50mph to 100mph (then 75mph over Nene River Bridge) between Fletton and Peterborough. Remodel north end of station to improve speeds over Spital ladder

■ GN/GE Southern Access (Werrington): Grade separation, exploring options for flyover or dive under

■ Doncaster Station Area: Construction of 100-metre long bay, bi-directional signalling to the Doncaster East Side (25mph) from Black Carr Junction to Balby bridge, with a new 25mph crossover on the Thorne lines

■ Shaftholme Junction speed increase: increase turnout speed from 20mph to 40mph and increase the Down Main Line speed from 100mph to 125mph

■ York Station North Throat: new line from platform 11 to the loco line to allow parallel moves into/out of platforms 9/10 and platform 11

■ Northallerton – Newcastle: freight loops at Ferryhill, Ouston–Birtley, Cowton–Eryholme

Not in list:

■ Woodwalton Junction to Huntingdon: reinstate Up Slow line

■ Stevenage turnback (new platform)

Source: Network Rail report for ORR, September 2014

At this point the Office of Rail and Road (ORR) could have, and probably should have, said ‘This isn’t working, we need harder numbers’. But the troop trains were running.

Instead, ORR introduced a new acronym, ECAM or Enhancements Cost Adjustment Mechanism. Under ECAM, as schemes reached GRIP3 (option selection), Network Rail gave the costings to ORR to check whether they represented efficient expenditure.

By June 2014 ORR was processing the first ECAM schemes. I was told at the time that any scheme which had not been signed off at GRIP3 by the deadline of March 2015 was likely to struggle for completion in CP5.

ECAM was a massive task, with ORR having to take on agency staff to handle the workload. Disturbing patterns started to emerge. Where I had expected that as the GRIP process refined the requirement, costs would come down, in many cases they went up. And ORR even found ECAM approved schemes coming back with a higher price tag.

Anyway, it soon became academic when, in 2015, newly-appointed Network Rail Chairman Sir Peter Hendy reviewed the troubled enhancements programme. When the results were published at the end of 2015, various schemes had been paused or deferred. It was claimed at the time that the £2.5 billion overspend was down to a few electrification schemes. But as we shall see this was another institutional delusion.

VTEC

Which brings us to Stagecoach and Virgin bidding for the Inter-city East Coast franchise in the spring of 2014, with CP5 just starting. According to the invitation to tender, from December 2018 the new franchisee would be required to ‘step up services as new Class 800/801 trains are accepted into service’. The full requirements of DfT’s tightly specified Train Service Requirement (TSR2) were to be introduced ‘no later than May 2020’.

TSR2 included a minimum off-peak frequency of six trains per hour (tph) to/from King’s Cross on Mondays to Fridays. It also required shorter average journey times between London King’s Cross, Leeds and Edinburgh.

Virgin’s response to TSR2 increased service frequency (currently 5tph) to 6tph from May 2019. This then increased to 13 trains every two hours from May 2020. The ‘half train’ is the path for VTEC’s proposed two-hourly Middlesbrough service, to be shared with FirstGroup’s five trains a day open access London to Edinburgh service.

Just to recap, the five schemes essential to meeting Virgin’s and FirstGroup’s access rights, granted by ORR in May 2016, are:

■ King’s Cross station throat remodelling;

■ grade separation at Werrington, near Peterborough;

■ restoration of the fourth track between Huntingdon and Woodwalton;

n an additional platform at Doncaster station; and

■ north east freight loops.

CLARIFICATION

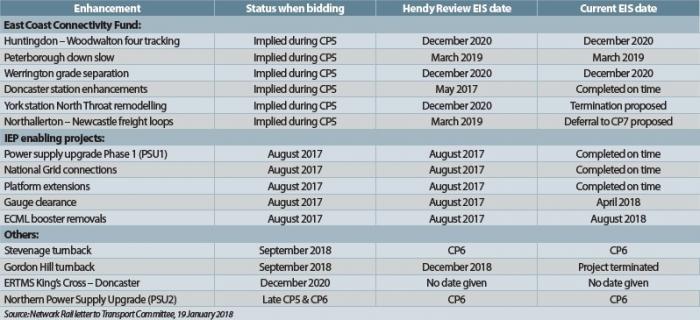

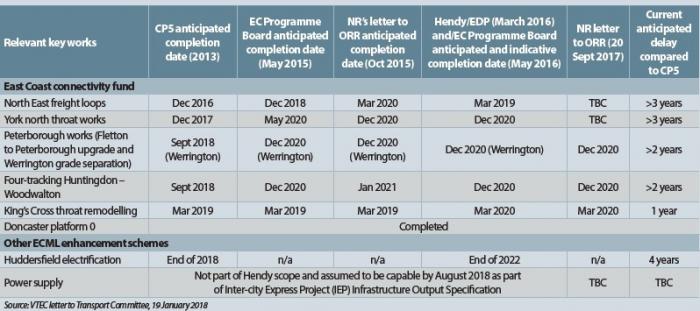

In January Lilian Greenwood, Chair of the House of Commons Transport Committee, wrote to Network Rail and VTEC seeking clarification on the infrastructure issues affecting the franchise. In his letter, VTEC’s Managing Director David Horne included Table 3, covering the history of the enhancements from 2013.

Rob McIntosh, Route Managing Director London North Eastern & East Midlands, provided the much simpler Table 2. This plays it by the book, literally, quoting the Entry Into Service (EIS) dates from Network Rail’s most recent Enhancements Delivery Plan.

Mr McIntosh also noted that the ringfenced £247 million East Coast Connectivity Fund (ECCF), intended to pay for capacity enhancements, was at an early stage of development during bidding for the Inter-city East Coast (ICEC) franchise. Network Rail was to work with industry to develop plans within the capped funding.

TABLE 1: STAGE OF NETWORK RAIL’S PROJECT DEVELOPMENT AT THE TIME OF THE STRATEGIC BUSINESS PLAN FOR CP5

TABLE 2: ECML ENHANCEMENTS CURRENT STATUS DETAILED IN THE DECEMBER 2017 EDP

At the time of the franchise bidding, Mr McIntosh explained, funding for individual projects had not been identified, nor had the outputs in terms of extra capacity been specified. Nor was Network Rail asked to endorse the final assumptions regarding infrastructure availability in the VTEC bid.

But note the date at the bottom of the detailed breakdown of ECCF capacity enhancements in the box (‘All for £247 million’, p24): September 2014, six months before VTEC took over the franchise.

SPECIFIED

In his letter, David Horne explained that DfT required bidders for the ICEC franchise to agree to operate a specified timetable with the new DfT-procured IEP train fleet: this is reflected in the VTEC Franchise Agreement. VTEC had a franchise obligation to deliver an enhanced train service, with faster journey times, from the timetable change date in May 2019, with a further step up in 2020. David Horne argues that ORR’s CP5 Final Determination ‘obliged NR to deliver most of the (upgrades) as part of the ECCF’.

TABLE 3: STAGECOACH AND VIRGIN UNDERSTANDING OF LATEST POSITION OF ECML ENHANCEMENT SCHEMES AT JANUARY 2018

A telling point made in the David Horne letter is that following the Hendy Review, Network Rail’s update of its Enhancements Delivery Plan (EDP) in March 2016, which re-prioritised a number of its schemes nationwide, was approved by the ORR. However, ‘ORR’s approval did not address the subsequent financial consequences of these changes’.

When the updated EDP was published VTEC warned DfT that Network Rail’s failure to deliver the ‘promised committed upgrades on the ECML would likely prevent VTEC from delivering several of its future obligations under the franchise agreement’. This would affect the finances of the franchise.

FREIGHT LOOPS

As an example of cost escalation, consider the three freight loops at Ouston, Bradbury and East Cowton in the two-track section between Northallerton station and King Edward Bridge Junction, just south of Newcastle. Bearing in mind that these were originally due to be delivered during CP5, which ends on 31 March 2019, it is surprising the scheme was not endorsed by the ECML Programme Board until April last year.

Remember that at current prices the ECCF is worth £260 million. The Hendy Review shunted £50 million back into CP6. A 2013 study put the Anticipated Final Cost (AFC) of the three freight loops at £35 million. The current estimate is £127 million.

So there is clearly an affordability problem. But VTEC is not the only operator with a commitment to run more trains over this section. Current traffic is five long-distance high-speed (LDHS) passenger trains an hour plus paths for two freight trains, either Class 4 intermodal or Class 6 bulk traffic. But come May 2021 things become much busier.

BUSY

Inter-city East Coast will need three paths an hour, TransPennine Express two, CrossCountry two and FirstGroup will be running five open access London to Edinburgh trains a day. I make that seven and a bit paths, one more than the six to be provided by the ECCF. And that is before you add in Arriva Rail North’s franchise commitment to a Newcastle – Durham – Middlesbrough service.

Freight demand is in a state of flux following the collapse of the power station coal market. Currently the Working Timetable shows 17 northbound paths at Birtley Junction, south of Newcastle, 10 of them empty coal or biomass, and 10 southbound between 07.00 and 20.00. Actual use is nearer one path per hour northbound and just under southbound.

Meanwhile, three alternatives to the three freight loops are being considered. These options are: upgrade the Stillington branch; upgrade the Durham Coast diversionary route; and reopen the Leamside line. Despite the cost increase, the freight loops remain the ‘most affordable’ of the options.

However, if only one freight path an hour was needed then the six LDHS paths can be accommodated within the existing infrastructure and the loops removed from the CP6 enhancements programme.

RE-QUADRIFICATION

British Rail ‘de-quadrified’ the 6.3-mile four-track section between Huntingdon and Woodwalton in the 1980s as an economy measure. This took the Up Slow line out of use but left a 1.75-mile loop between Woodwalton and Conington.

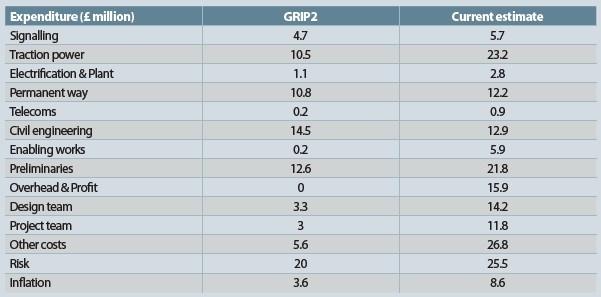

TABLE 4: HUNTINGDON – WOODWALTON FOUR-TRACKING COSTS

When the ECML was electrified the piled foundations for the Up side support masts were driven into the ‘four foot’ of the disused Up Slow formation. Now re-quadrification is required to provide the capacity needed for the 2020 timetable, engineers are in a quandary.

Do they take extra land, requiring a Transport and Works Act Order, so that the reinstated fourth track runs outside the existing electrification masts? Or do they remove the existing structure and put in new masts outside the four tracks and replace the headspans with gantries?

Well, those are the official options. To me, the obvious and cheapest solution would be to leave the existing electrification alone, shift the Up Slow to the east slightly and hang gantries off the existing masts which, since they have to take the tension of the headspan, are pretty rugged.

COST

Ideally, the reinstated fourth track would run into the existing Conington Loop. This full-house solution was costed at £85 million at GRIP2. Now the scheme has been taken to GRIP3, the cost has become an unaffordable £190 million.

As a result, various cut-down options are being considered. These reduce the length of the four-track section by a small amount, although the option of adding a link into the Conington loop remains. Anticipated Final Cost (AFC) now ranges from £125 to £180 million.

Table 4 provides an insight into Network Rail’s struggle to contain costs. Take traction power, for example. GRIP2 assumed the use of the British Rail Mk 3b overhead line equipment, as installed on the ECML.

Now we have the Network Rail ‘Master Series’ (‘Informed Sources’, November 2017 issue). For the four-tracking a hybrid system incorporating Mk 3b components is being developed.

OVERHEADS

When comparing current costs with pre-privatisation projects, you need to remember today’s prices include Schedule 4 compensation paid to train operators to cover their notional losses from disruption. Taking the four-tracking from GRIP2 to GRIP3 has revealed that significant sections of the scheme will require All Line Blocks to carry out, rather than the Adjacent Line Open (ALO) anticipated at GRIP2.

However, three sets of costs in the table do merit a raised eyebrow. Network Rail’s Infrastructure Projects (IP) adds a mark-up to cover its costs and this contributes around 10% in this case. The design and project teams’ costs also seem high given the scope of the scheme.

While they are two radically different schemes, it is instructive to compare the £350 million for the Trent Valley four-tracking on the West Coast main line, which added 24 miles of electrified track. In addition to widening the alignment, 37 structures had to be replaced or modified. That comes out at £14.6 million per track mile, versus £21 million for the cheapest Huntingdon to Woodwalton scheme. I suspect economy of scale may play a part here.

DIRECT ACTION

Finally, there’s the power supply north of Doncaster. Responding to questions from the Transport Committee on 22 January, Transport Secretary Chris Grayling was bullish.

Following his intervention ‘some months ago’ with Network Rail, he expects the power supply necessary for IEP to operate north of Doncaster to be available. ‘We now have plans in place that will enable that to happen. There is no risk to the introduction of the Inter-city Express trains’, he declared.

Network Rail submitted options for PSU2 to DfT in October 2017.

These are currently at GRIP3. However, ORR’s final determination for CP5 did not include PSU2 under the ‘East Coast Power Supply Upgrade for IEP’ programme. The cost will have to be met separately.

A phased upgrade is being proposed, with the initial stage providing sufficient power for IEP services. Additional capacity would then be added to meet the electrical demand from the additional paths required by VTEC, TransPennine Express and FirstGroup’s open access London to Edinburgh service when the other capacity enhancements are completed.

CONTINUITY

Network Rail is working to have the capacity enhancements in place for the May 2021 timetable. Which brings us back to the VTEC crisis.

Foaming radicals want the ICEC franchise taken over by DfT. When Directly Operated Railways was shut down in 2015, DfT outsourced the role of ‘operator of last resort’ to an Arup-led consortium including Ernst & Young and SNC-Lavalin Transport. Messianic Transport Secretary Chris Grayling wants to have a new Regional Partnership between ICEC and Network Rail running the ECML from 2020.

They are equally deluded. If the schemes analysed above, plus other essentials like grade separation at Werrington, are to be completed by May 2021, the ECML is going to be a series of building sites.

At the same time, Hitachi will be replacing the existing ICEC fleet with Class 800/801 electric and bi-mode trains, including taking over maintenance. Meanwhile, the operator will be trying to maximise the use of the new trains within the capacity available for the May 2019 and May 2020 timetables.

Is this really the time to be bringing in a new operator, while reletting an untried and barely thought out Partnership concept, which his civil servants have told Mr Grayling is impractical, with all the distraction implied for both the train operator and Network Rail’s LNE&EM Route? Not forgetting that the Route is already in the throes of reorganising under Network Rail’s devolution programme.

So the only rational policy is to negotiate a management contract for David Horne and his existing team to cover the period from whenever VTEC runs out of money to the end of CP6 in 2024. But does the Government have the nerve?

ORR ACCESS DECISION

Network Rail’s advice was that enhancements are needed on the ECML to enable an additional hourly service to run, in particular, four-tracking at Woodwalton and grade separation at Werrington. These projects are currently due to be completed in time for the May 2021 timetable. We will therefore direct Network Rail to agree firm rights for the additional hourly path for VTEC from May 2021 rather than from May 2019 as VTEC originally requested.

In addition, we will direct Network Rail to agree contingent rights for the additional hourly path for VTEC from May 2019. Contingent rights will allow the path to be utilised should the projects be delivered early or found not to be needed after all. ORR, 12 May 2016

TOYS OUT OF PRAM

I can’t conclude without reminding readers that in 2016, when ORR was consulting on the ECML access applications, DfT wrote that while ‘minded to proceed’ with the ECCF enhancements, granting rights to open access operators might detract from the business case. The Secretary of State’s decision whether to proceed would depend on ORR’s decisions on open access ‘and may need to be reconsidered after those decisions’.

So, less than two years ago, a petulant DfT was threatening to bin the ECCF enhancements.

REQUIREMENTS ACKNOWLEDGED IN 2012

Forecasts of future growth indicate that the route will need to accommodate additional services from 2019. To accommodate this, the rail industry has proposed that a series of further infrastructure enhancements are investigated for possible implementation during CP5. These include:

■ between Huntington and Peterborough;

■ at Peterborough station;

■ at Werrington Junction, north of Peterborough;

■ at Doncaster station; and

■ between Darlington and Newcastle.

The Government will publish its HLOS requirements for CP5 by the end of July 2012.

Inter-city East Coast franchise consultation document, June 2012